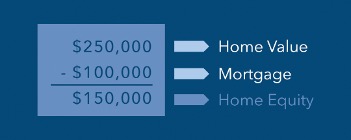

Your home’s equity is an important asset that you could be leveraging for extra funds. Your equity is calculated from subtracting your home’s value from the amount you may still owe on your mortgage.

Use when needed

When you open a home equity line of credit (HELOC), the funds are available for you to use as needed. You can borrow funds for a special project and pay yourself back over time.

Improve your home’s value

Many people use a HELOC to fund a renovation or landscaping project for their home. This is a great way to increase the value of your home, which gives you even more equity. Of course, you can also use the funds for other reasons, such as paying for educational costs, debt consolidation, or other major life events.

Apply once

You will only need to complete one application for a home equity line of credit. After applying once and getting approved, you can borrow repeatedly over the lifespan of the loan. No closing cost options are also available.

To learn more about home equity loans or other home loan options through Tri City National Bank, reach out to one of our hometown mortgage lenders today.

Member FDIC. Equal Housing Lender. NMLS: #433891