Bank outside the branch

We’re big enough to serve you — and small enough to fit in your pocket! Bank from any device at any time with our digital services! From credit score insights to online banking, Tri City has the tech to help you succeed. Enroll below to get started!

Mobile App Download

Download the Tri City mobile app from the App Store or Google Play.

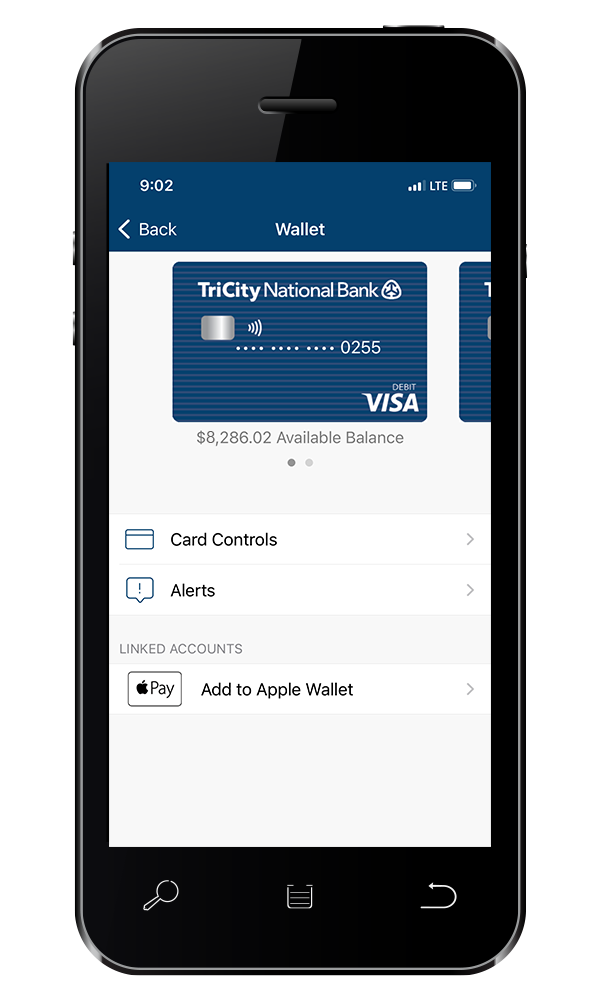

CONNECT TO APPLE PAY

Link your Tri City debit card to Apple Pay or other digital wallets.

MOBILE WALLET UPGRADE

Organize your debit cards in the mobile wallet folder.

BILL PAY PAYEE INFO UPDATE

Manage payee info for your bills from the mobile app.

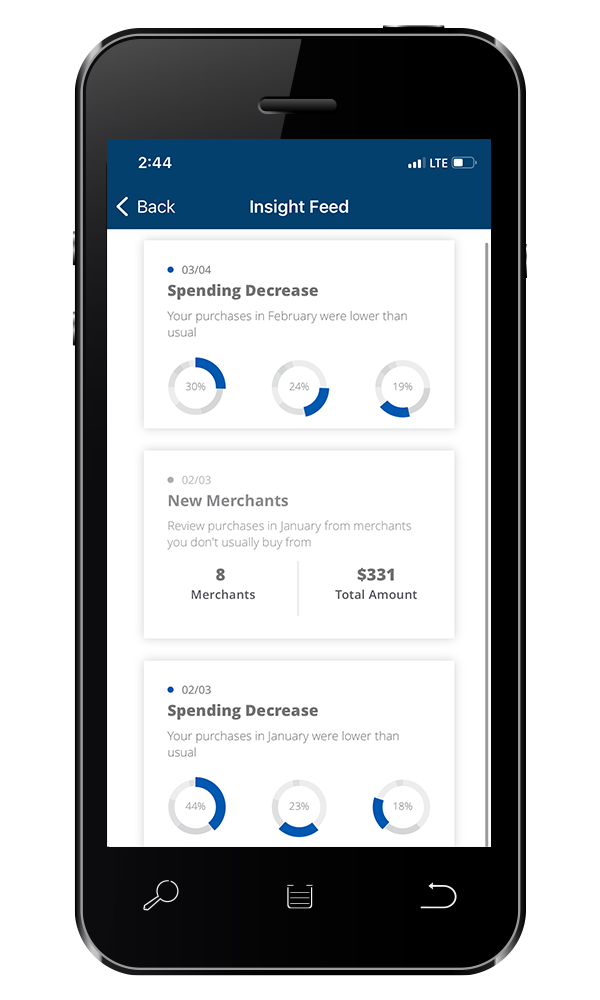

Spending insights

In the Tri City mobile app, get in-depth report of your spending history for the month, review your cash flow tracker, and more.

Mobile Wallet

Open your wallet in the app to access debit card controls and alerts, organize your debit cards, and link your debit card to Apple Pay.

Controls and Alerts

Debit card controls and alerts let you limit where and how your debit card is used. You can enable or disable these features at any time in your mobile app by navigating to More > Card Controls1 or More > Alerts1.

- Add or remove cards.

- Enable or disable cards.

- Limit transaction or merchant types.

- Enable or disable international transactions.

- Set alerts by a specific threshold and more.

Online Bill Pay

With Online Bill Pay, you can pay ongoing bills or make one-time payments with ease! More secure than paper billing, Online Bill Pay has many other benefits as well:

- Schedule payments in advance.

- Set up payment reminders.

- Ensure payments are received on time.

- Keep all payee information in one convenient place.

- Avoid paper clutter.

Digital Banking FAQ

What types of accounts can I access on Online Banking?

You can see all your Tri City deposit accounts — checking, savings, money markets and CDs — and your loans.

How far back can I go into my account activity in Online Banking?

You can see your account activity and images of your checks up to 540 days prior to the current date. If you have signed up for Online Statements, you can access up to 7 years’ worth of past statements from the current statement period.

How do I sign up for Online Statements?

After logging into Online Banking, click on “Documents.” You will be able to access and print up to 7 years’ worth of past statements from the current statement period. Images are available with Online Statements at a cost of $4.00 per month.

I have a joint checking account with my spouse. Do we both need to enroll separately, or can we share one Online Banking account?

Your User ID is your personal link to Online Banking. Each person should have their own individual User ID and password even if they are both signers on the same accounts.

My account shows two different balances. What do these balances mean?

The available balance is your balance shown in real time. Your available balance may change throughout the day as certain pending transactions, such as ATM withdrawals and debit card purchases, are conducted on your account. These pending transactions may not be immediately listed in your related account activity.

When pending and other transactions, such as checks, clear your account, they will be reflected in your current balance. In addition to impacting your current balance, these transactions will appear in your related account activity.

How can I transfer funds between accounts via Online Banking?

To be able to transfer funds between any of your Tri City National Bank checking, savings or money market accounts, the accounts must meet certain titling requirements, and you must have a signed Balance Transfer Agreement on file.

For more information or to complete a Balance Transfer Agreement, please speak with a Customer Service Representative at any of our locations.

When will transfers I conduct through Online Banking take place?

If you initiate transfers between your Tri City National Bank checking, savings or money market accounts before 8:00 p.m. CST, the transfer will take place on the same business day. If you initiate the transfer on or after 8:00 p.m. CST, the transfer will take place on the next business day.

What type of Stop Payments can I conduct through Online Banking?

You can process Stop Payments on checks that have not already posted to your account. You are not able to process a Stop Payment on a preauthorized electronic debit via Online Banking because the debit does not have a check number (which is required).

Please contact a Customer Service Representative at one of our branches or through Telephone Banking for more information or to complete the necessary paperwork to revoke preauthorized electronic debit.

A $35.00 fee will apply to each Stop Payment request.

What is the dollar limit on Online Bill Pay payments?

The limit is $5,000.00 in total payments per day.

Are there any bills I can’t pay using Online Bill Pay?

Currently, you can’t make payments to government agencies for items such as property taxes and alimony. Any other bills can be paid by adding the biller as a payee in the Pay Someone New tab.

Payees may be individuals and small businesses and do not need to be able to accept electronic payments. If a payee is unable to process electronic payments, a check will be mailed to the payee instead.

How far in advance can I schedule payments?

You can schedule payments up to 1 year in advance.

Can I schedule recurring payments?

Yes. Choose “autopay” under the payee’s information on the Pay One or Pay Many page.