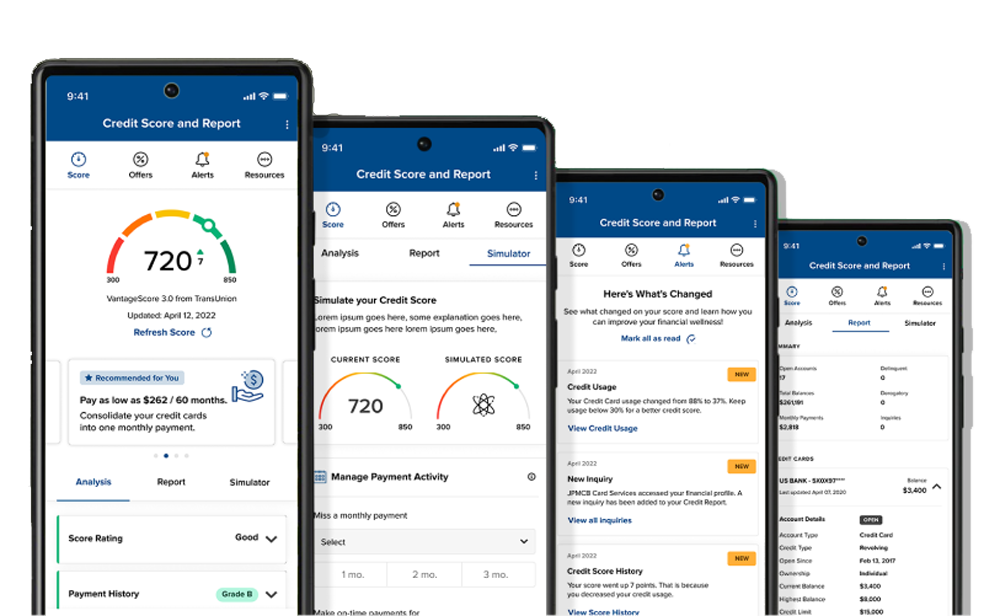

Your Credit Score and More. Anytime. Anywhere.

Staying on top of your credit has never been easier. With one powerful tool, you can access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your credit score, and for free1, right from our mobile app.

Free Mobile App Download1

Once enrolled in digital banking, download the free1 Tri City mobile app from the App Store or Google Play.

Benefits of credit score:

- Daily Access to your Credit Score

- Real-Time Credit Monitoring Alerts

- Credit Score Simulator

- Personalized Credit Report

- Special Credit Offers

- And More!

The benefits are endless, so there is no need to wait.

Credit score FAQ

What is Credit Score?

Credit Score helps you stay on top of your credit by providing your latest credit score and credit report, helping you understand key factors that impact the score. It also monitors your credit daily and informs you by email if any significant changes are detected, such as a new loan being opened, a change in address, employment, delinquency, or inquiry has been reported.

Does Credit Score offer Credit Monitoring as well?

Yes. Credit Score will monitor and send email alerts when there has been a change to your credit profile.

Is there a fee for Credit Score?

Credit Score is entirely free1 to Tri City National Bank customers.

Will accessing Credit Score "ding" my credit and potentially lower my credit score?

Credit Score is a "soft inquiry" which does not affect a credit score. Lenders use "hard inquiries" to make decisions about creditworthiness when you apply for loans.

How often is the credit score updated?

The credit score will be updated every seven days and displayed in mobile banking. You can click "refresh score" as often as every day for an updated credit score.

What if the information provided by Credit Score appears to be wrong or inaccurate?

Credit Score shows the most relevant information from a credit report. If you think some information is wrong or inaccurate, you can obtain a free credit report from www.annualcreditreport.com and then dispute inaccuracies with each bureau individually. Each bureau has its process for correcting inaccurate information, but every Tri City Credit Score user can "File a Dispute" with Transunion by clicking on the "Dispute" link within Credit Score. Transunion will share this with the other bureaus if the inaccuracy is verified.

Why do credit scores differ?

Three major credit-reporting bureaus (Equifax, Experian, and Transunion) and two scoring models (FICO or VantageScore) determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 credit report factors may be considered when calculating a score, and each model may weigh credit factors differently, so no scoring model is identical.

Will Tri City use Credit Score to make loan decisions?

No. Tri City may make loan offers to customers who could benefit from a loan based on Credit Score. Once a loan application is submitted, Tri City has several factors in making its loan decision, including credit history, income and employment, debt to income ratio and collateral, for example.